Point and figure is a technical analysis theory with more than one hundred years of history. It is one of the oldest trading theories ever developed, traced for the first time in 1898 in the book Game in Wall Street.

Why would anyone be interested in a trading theory that old? Also, does it work in the 21st century, as the financial markets have changed dramatically in the last century? This article intends to answer these questions, and the readers will judge if point and figure deserve a place in a technical trader’s toolkit.

Technical analysis’s incipient phases can be tracked to the start of the previous century. Theories like the Dow, Gartley, Elliott Waves, and Gann were all developed in the first half of the 20th century. It makes sense because technical analysis is the art of forecasting future prices based on historical price data. But during those years, the only 2 markets were the commodity and the stock markets, with little or no data on the latter.

However, things changed. The basis for point and figure trading well serves the long-term investor interested in catching strong trends early in their incipient phases and avoiding the market “noise.”

Today, point and figure as a trading theory is not so popular among the new generation of traders for the simple reason that a point and figure chart is very different from other popular charts. Also, the trading techniques have been lost over time, and many traders don’t know what to do with a point and figure chart.

This article intends to answer all these questions. By the end of it, the reader will know how to read a point and figure chart and how to trade the currency market using this theory.

A Short History of Point and Figure Trading

Point and figure first became popular in the 1940s after Victor DeVilliers wrote a book dedicated to it in 1933. As mentioned earlier, these were the times when most of the technical analysis trading theories were built and became so popular because the stock market “game” was increasingly popular, too.

But the theory reached a new level once Jeremy du Plessis wrote a book about it that became an instant hit at the time. He used plenty of graphs and charts to explain market movements and to document patterns. Moreover, it was the first time he used letters (i.e., Xs) instead of numbers, so this is how the points charts were introduced. In fact, du Plessis remains accredited with the terminology of point and figure.

Later down the road, the point and figure trading theory lost its appeal. New theories caught traders’ attention, theories that were less time-consuming and gave promising results.

Fibonacci numbers and ratios have become more and more popular, widely used by the Elliott Waves Theory as well as by the Gartley method. The Gartley method was further expanded in the 1970s, which is about the time when the point and figure trading theory became less popular.

It all changed with the rise of computers. Personal computers made it possible to overcome one of the biggest downfalls of the point and figure theory – it is time-consuming.

Updating a chart is time-consuming, but that is no longer a problem since computers can do it for us. Since the 90s, the point and figure charts have regained their place in the trading platforms and are now offered by most brokers.

Understanding Point and Figure Charts

There are different types of trading charts. This trading academy covered the most popular charts and various other types, and we should make a further distinction between the charts offered by default by a broker and the charts that can be created.

For instance, any trading platform in 2021 offers at least 3 types of charts – candlesticks, bars, and lines. Of the 3, the candlestick chart is the most popular. It replaces the bar chart, used by veteran Wall Street traders all the way until the end of the 90s. However, the candlestick chart has an important advantage over the bar chart, as candlesticks make it easier to spot the entire price action in a period.

Therefore, a candlestick chart is the most popular among retail traders (and others) today. The fact that candlestick patterns take a very short time to form gave them a competitive advantage over the classic technical analysis patterns. For example, the head and shoulders pattern, one of the most representative of the classic technical analysis, takes a lot of time to form. In contrast, the hammer pattern, belonging to the Japanese candlesticks, needs only 1 candlestick.

But even if the broker’s trading platform offers only these 3 types of charts, the trader can import indicators that “transform” the chart. For example, when using the MetaTrader, the most popular trading platform among retail traders, importing an indicator that transforms the price action from a regular line, bar, or candlestick chart to a point and figure chart is fairly easy.

Another way to access point and figure charts is to make use of public platforms that offer them for free, such as TradingView. Their platform incorporates many types of charts and indicators, although some of them are only accessible for a fee. For example, using a point and figure chart on timeframes shorter than the daily one requires a fee, but point and figure was not built to be used on such timeframes in the first place.

What Makes a Point and Figure Chart?

Before explaining the concept of a point and figure chart, traders must start with an open mind. The concept, while easy, may need a bit more attention for its intricacies to be fully grasped.

The first thing to know about a point and figure chart is that it eliminates the time element. Not all of it, but most of it. More precisely, it accounts only for important price changes and filters the unimportant, irrelevant market moves.

The second thing to know is that a point and figure chart uses a combination of Xs and 0s. Therefore, instead of bars or candlesticks, the trader is presented with Xs and 0s, whose significance needs to be understood in order for the chart to be interpreted.

Finally, the last thing to account for is how the price action occurs on a point and figure chart. In sharp contrast with all other charts, the point and figure chart’s price action takes place vertically, not horizontally.

To sum up the above points, a point and figure chart is a:

- Combination of Xs and 0s.

- Chart that shows the price action on the vertical.

- Technique that eliminates the useless time on a chart.

Xs and 0s

This article uses the TradingView charting to explain the point and figure trading theory. Below, you can find the EURUSD daily timeframe on a candlestick chart.

A candlestick chart is composed of periods (candlesticks) that show the price action from the opening of a candlestick to its closing. For example, this being the daily chart, each candlestick shown above represents 1 trading day. Moreover, red signals bearish price action (i.e., the closing price is below the opening price), while green signals bullish price action (i.e., the closing price is above the opening price).

But the chart shows all periods, candlesticks, regardless of the price action. This is where the point and figure chart comes with a major improvement, as it discounts the useless periods or the periods where nothing important happens from a price action point of view.

A point and figure chart is a combination of Xs and 0s. More exactly, a combination of columns of Xs and 0s.

Typically, columns of Xs are shown in green, representing bullish price action. Columns of 0s represent bearish price action, shown in red.

Hence, an X is a sign for bullish price action, while a 0 is a sign of bearish price action. Therefore, a column of Xs shows a bullish trend, while a column of 0s shows a bearish trend.

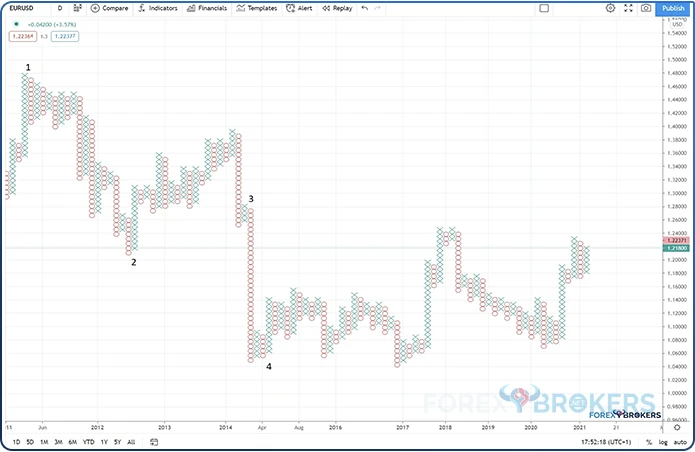

Below you can find the same EURUSD chart, but this time using the point and figure concept. Suddenly, the chart looks different, and everything from a candlestick chart is lost.

Differences between Point and Figure and Normal Charts

The first thing that strikes the eye is time. If we compare the time shown on the 2 charts, we notice a sharp difference. As such, the candlestick chart only shows the price action during the last 4 months, while the point and figure chart shows the price action in the last DECADE on a similar chart window.

Second, trends on a point and figure chart develop vertically, not horizontally. Have a look at the year 2014 on the chart above. The 2 columns of Xs make up for a huge bearish trend on the EURUSD pair, which took only 3 vertical lines of all lines in the chart. In sharp contrast, on a regular chart, one would need a multiple timeframe analysis to cover the entire price action during the period.

Now that we have established a point and figure chart, it is time to look at what makes the columns change from bullish to bearish or from bearish to bullish. More precisely, what needs to happen in the market so that a column of Xs turns into a column of 0s? Or, what happens so that a column of 0s turns into a column of Xs?

For this, we need to understand reversals with point and figure charting. This is a key concept that may easily change the way a chart is plotted.

3-Box Reversals

A reversal happens when market conditions change. In the case of point and figure trading, an X or a 0 represents one box.

The reversal distance needs to be agreed upon beforehand. It depends a lot on the financial asset’s volatility.

This is the distance that triggers a change in market conditions. How much does the price need to retrace so that a bullish or bearish trend is invalidated?

Not all financial assets have similar volatility. Even the currency market is composed of currency pairs with bigger volatility than others. For example, the AUDNZD cross is much less volatile than the EURAUD cross. Or, the GBPUSD major is much more volatile than the USDCAD major.

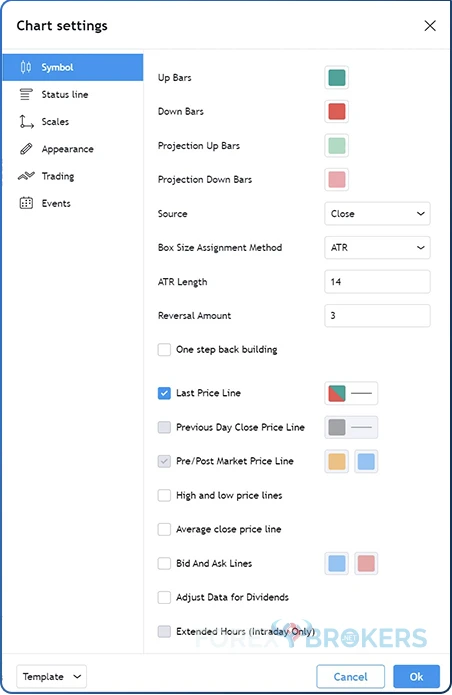

Back in the day, the distance for 1 box was set arbitrarily based on how the underlying market moved. Nowadays, the software makes it easier to pick the size of 1 box, and thus the conditions for a reversal, by using a well-known indicator – the ATR, or the Average True Range.

ATR as the Basis for Box Reversals

The ATR calculates the average distance traveled by the market over a number of periods. That represents 1 box.

From this point, the next thing to implement in the point and figure analysis is the number of boxes that make up a reversal. Back then, a 5-box reversal was popular, but the most popular metric today is the 3-box reversal. Effectively, it means that for a point and figure chart to change the columns from Xs to 0s or from 0s to Xs, the actual price action in a period (i.e., day) should exceed the ATR by 3 times. If not, the trend continues.

But this represents a condition not only for a trend reversal but also for a trend continuation. Therefore, if the price action is less than the 14-day ATR in a bearish trend, the chart will not plot another X. Or, in a bullish trend, it will not plot another 0 if the market does not move more than the 14-day ATR.

The image below further explains the concept. It considers the closing price of the previous 14 periods and calculates the ATR. If the price action in a single day exceeds the ATR by 3 times, the point and figure chart plots a new column. If not, the trend continues, and the spike higher is nothing but noise.

Filtering the Noise

Market noise is one of the reasons why so many rookie traders fail in their attempts to succeed. That is particularly true in the case of the currency market, where volatility may reach extreme levels.

A trading technique that “filters the noise” is desirable. Imagine how many economic events impact the daily price action and how fast the markets react due to algorithmic and high-frequency trading. All these are filtered by a disciplined approach given by the point and figure charting.

Sometimes, traders have a hard time coping with the market going in the opposite direction of their trade. But this is how prices move – not in a straight line, but in a series of higher highs and higher lows, as well as lower lows and lower highs. The point and figure technique helps to filter the periods of false breakouts and keep them on the right side of the market.

Advantages and Disadvantages of Using Point and Figure

It has become clear by now that one of the main advantages of using a point and figure chart is time compression. More precisely, on the same chart, more historical data is available to interpret to the trader’s direct advantage.

Moreover, a point and figure chart makes it easier to interpret trends. Or to see trends clearly and stay on the right side of the market without being distracted by the pullbacks.

Furthermore, a point and figure chart offers great money management tools. Traders use a new X or 0 as a place to add to an existing position.

On the flip side, the point and figure trading theory works mostly on longer timeframes. Once the trader goes on the shorter ones, say, shorter than the daily chart, the strategy loses its effectiveness. Because of that, it is vital that the traders know how to adjust the risk and reward, as well as their expectations regarding future market movements. In other words, traders need to give time to a trade to reach the target.

How to Trade with Point and Figure

The point and figure theory is a trend-following theory, as well as a countertrend one. However, even when used to trade against the main trend, the point and figure provide an entry only after the market has reversed. Hence, we may say that it helps traders spot trend reversals after the fact but still allows them to enter the new trade at an early stage.

The second part of this article deals with trading strategies involving the point and figure theory. We will look at how to trade reversals, as well as how to use the famous 45-degree angle to enter the market. Of the 2 techniques, the one involving reversals is by far more popular.

Trading Reversals with Point and Figure Charts

To illustrate how to trade reversals with the point and figure theory, we will use the same EURUSD daily chart from earlier. On the chart below, 4 positions are marked that serve as examples of reversals.

Point and Figure Reversals – Example Nr. 1

At any top or bottom, the columns of Xs, respectively 0s, change. In a bullish trend, at the top, the chart fails to post a new X, but instead, a 0 appears. Remember what this means – that the market traveled a larger distance in the opposite direction than the 3-box reversal explained earlier. Hence, staying on the long side makes no sense anymore.

However, let’s assume that the trader was not long in our first example. In fact, let’s assume the trader was bearish, for whatever reason (i.e., fundamental), and waited for a chance to short the market. As mentioned earlier, the point and figure trading theory requires discipline and patience to wait until a reversal is confirmed.

On the chart below, we first see that a column of 0s started to form. In other words, the market turned bearish.

However, at this point, we don’t know if this is just a correction of the previous bullish trend or the start of a new bearish trend. For this, we need to wait for 1 of 2 things to happen – either a new column of Xs fails to make a new higher high, or the new column of 0s is so strong that it makes a new lower low when compared to the previous column.

In this case, we see that the initial bullish trend was strong enough for the point and figure chart to start a new column of Xs. However, the new column failed to make a new higher high when compared to the previous column of Xs, which is a sign of weakness.

Even the subsequent columns of Xs failed to break the established series of lower highs, and from that moment on, all that traders need to do is wait for a new column of 0s to start. Once the bearish market unfolds does not stop until the lower highs series is broken. In numbers, the point and figure short trade covered a distance from 1.45 to 1.28, approximately.

Point and Figure Reversal Trading – Example Nr. 2

Our second example continues from where the previous one ended. By the time the column of Xs broke the lower highs series made of other columns of Xs, it became obvious that a reversal was in place.

The market even formed a false reversal – it formed 2 lower lows, marked by the 2 columns of 0s, but the columns of Xs did not form a lower high.

Hence, the bullish trend continues, and the second example showed how traders using the point and figure technique had the opportunity to ride a bullish trend from 1.28 to 1.36 by respecting some simple trading rules.

Point and Figure Reversal Trading – Example Nr. 3

The third example shows a huge bearish column of 0s. Aggressive bears added to the original short position by the time the chart plotted the first 0 after the small column of Xs.

Conservative bears, on the other hand, preferred to wait for the new column of 0s to make a new lower low when compared to the previous one. That was the signal to ride the trend to the downside and a bullish reversal occurred only into the 1.08 area after the market fell from 1.28.

Point and Figure Reversal Trading – Example Nr. 4

The last example showing a point and figure reversal follows the same steps as explained earlier. While the bearish trend dominates, the market is strong enough and forms a column of Xs.

At this point, bulls do nothing. A new column of 0s forms as bears try to take back control. However, the new column fails to make a new lower low, showing a divergence from the bearish trend.

All that was left at this point was for the upcoming column of Xs to break the previous column of Xs’ high to generate an entry on the long side.

The 45-Degrees Point and Figure Trading Strategy

Another way of trading with point and figure charts is to make use of a 45-degree trendline. The concept of a 45-degree trendline is well known in advanced technical analysis, especially by traders that use the Gann theory.

The idea behind the 45-degree angle trendlines is that they define a market decline or a market advance. The concept is straightforward, as the line acts as a delimitation between bullish and bearish market conditions.

In other words, as long as the price remains below the 45-degree trendline, the bearish conditions prevail. When it holds above the 45-degree trendline, bullish conditions prevail.

Unfortunately, not every trading platform offers the tools to find the 45-degree angle. However, technical traders may overcome this by drawing one horizontal and one vertical line to find a 90-degree angle. By splitting it into 2 parts and drawing a line in the middle, the 45-degree angle line is achieved.

Here are the rules to apply when using the 45-degree angle trendline with point and figure charting. First, the trendline must start from the most recent top or bottom. Second, if the columns of Xs and 0s pierce the trendline, it does not represent an invalidation of the trend. Instead, the focus shifts to the market’s strength to break the previous higher low (in a bullish trend) or lower high (in a bearish trend).

On a failure, every time the market moves back below the 45-degree trendline (in a bearish trend) or above it (in a bullish trend), it represents an opportunity to enter the market in the direction of the underlying trend.

How to Set the 45-Degree Angle Trendline

Before anything, keep in mind that the 45-degree angle trendline must have the starting point from the previous top or bottom. By the time the trader has identified the angle, the focus is on finding false breakouts and then entering the market in the direction indicated by the trendline.

For example, let’s assume that the market reverses from the highs. It formed a column of Xs and then reversed. One way to trade the reversal is by using the steps described in the previous sections of this article. Another way is to use the 45-degree angle trendline. Or to use a combination of both.

The chart below shows the 45-degree angle trendline on the EURUSD daily timeframe. If we use the same examples as when explaining the reversal strategy, we apply the 45-degree angle trendline as seen below.

Remember that when drawing the trendline, it may or may not already be pierced by the columns of Xs and 0s. This is because it takes some time to know whether a top or a bottom is in place.

Interpreting the 45-Degree Angle Trendline

The next thing to do is to interpret the trendline. Or to interpret the market’s behavior around the trendline.

The first thing to notice is that immediately after forming a new lower low, thus confirming the bearish trend, the market bounces and breaks the trendline to the upside. Because the 2 columns of Xs do not make a new higher high compared to the previous one, the breakout to the upside is false. Hence, traders should fade it and wait for the market to reverse back to below the 45-degree angle trendline.

It did so twice, offering 2 entries to the short side from about the 1.41-1.42 area. The exit from the short trades came when the market broke above the trendline again, only this time, the column of Xs broke above the previous column of Xs’ lower high.

As a rule of thumb, the more often the price action reverses to the trendline and pierces it, the weaker the trend becomes. Now that the market has confirmed a new bottom, we can use the same principle, only this time the 45-degree angle trendline is bullish. Hence, we look to enter the market on the long side.

Bullish Setups with the 45-Degree Angle Trendline

Because of the bullish reversal, we can use the bottom confirmed by the time the market broke the series of lower highs to build the new 45-degree angle trendline. This time, we will look for bullish signals, following the same principle as explained above.

Remember to pay attention to the moment when the price action (i.e., the columns of Xs and 0s) pierces the 45-degree angle trendline. The job at hand is to interpret if such a break is false and, if not, to wait for the market to reverse back above the trendline before going long or buying.

This is exactly what we notice in the chart below. First, we draw the 45-degree angle trendline from the confirmed bottom. Second, we wait for 1 column of 0s to break it. That is, for at least one 0 to be plotted below the 45-degree angle trendline.

In this example, the point and figure chart plotted 2, not 1, 0s, giving the impression that the bears are in control. At this point, we do nothing but wait. It is time to find out if the bearish breakout is real or false.

If it is real, then the column of 0s should have continued with at least 2 more 0s, so that the previous higher low was broken. It did not. Instead, it reversed and moved back above the 45-degree angle trendline. That is the signal to go on the long side, at about 1.30.

A better illustration can be found below. The column of 0s breaks the 45-degree angle trendline, then another column, this time of Xs, reverses above. When the first X above the trendline appears, it is time to go long.

Bulls may always want to stay on the long side when the price action remains above the 45-degree angle trendline. How about the exit?

When the newly formed column of 0s broke the 45-degree angle trendline, it continued and also broke the previous higher low. Hence, the bullish trend ended, and a new trend, a bearish one, started.

The market does not always test the 45-degree angle trendline. As seen below, sometimes it is impossible to find an entry using this strategy. However, most of the time, the market does pull back in such a way as to warrant an entry.

Conclusion

Point and figure is one of the oldest trading theories in the world. Over time, it underwent some changes from the original concept, changes viewed as constructive by the generations of traders that followed.

The theory comprises time in such a way that it is possible to analyze a decade or more of price action on a single chart. No other type of chart offers this possibility, making the point and figure theory popular among the investing community.

The theory was not built for short-term trading or scalping. Instead, it was developed with the purpose of riding the longer trends.

Point and figure is used to spot medium to long-term trend reversals but also to add to a position when the trend resumes. The 45-degree angle trendline offers a visual perspective of the underlying trend, leaving no room for error.

While the columns of Xs and 0s are not familiar among modern traders, they do show bullish and bearish price action, respectively. The theory discounts the time that the market spends in consolidation. Therefore, if the market does not advance or decline more than the reversal box set by the trader, the chart will not plot an X or a 0, but it will just wait for the next period and see if the conditions for a reversal or continuation are in place.

To sum up, point and figure complements the technical analyst’s toolbox. It represents the ideal trading technique for the trader who does not have a lot of time to spare in front of screens and offers impressive results.