Online Trading Platforms – Essential Tools and the Backbone of Modern Trading

Online trading spread incredibly quickly since the Internet made connecting buyers and sellers easier and faster. Smartphones pushed things even further, as they enabled trading on the go.

Infrastructure is critical in attracting and retaining customers. The trading platform is the tool traders use to instruct the broker what to sell and buy, when, and in what volume. Also, it is used by traders to conduct technical analysis studies and back-test various strategies for automated trading.

Therefore, trading platforms are vital for forex brokers and traders. Brokers try to improve it and constantly offer the best conditions to traders. On the other hand, traders have high expectations regarding the platform they use as their trading success depends, to some extent, on the trading platform too.

Best Trading Platforms for All Types of Traders

There are several online trading platforms dedicated to retail traders. In the following paragraphs, we will present a list of the most popular ones, a short description, and the pros and cons of using each platform.

- MetaTrader 4

- MetaTrader 5

- TradingView

- cTrader

- ZuluTrade

- NinjaTrader

MetaTrader 4

MetaTrader 4 is, by far, the most famous and popular forex trading platform among retail traders. Its simplicity attracts traders. But that does not mean it has limited capabilities.

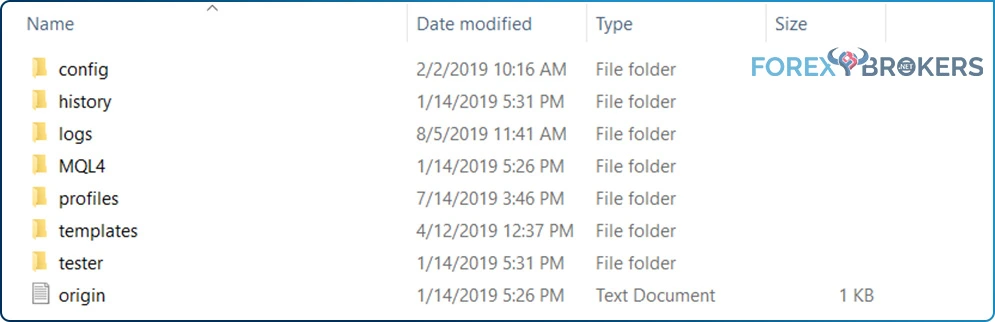

The installation process is straightforward and user-friendly. The platform comes with a basic set of indicators, but one can import any indicator as long as it is built according to the MQL instructions. Therefore, it can be customized.

Also, it supports automated trading. Traders can build their EAs and then import them on the platform. MetaTrader4 makes it easy to run them and even back-test the results for long periods.

Hedging is allowed on this version of MetaTrader. This means traders can simultaneously open long and short trades on a currency pair. At times, hedging protects the trading account from unnecessary drawdowns, and MetaTrader 4 allows such strategies.

Charts can be customized, too. Traders can opt from three types – line, bar, and candlesticks, but can also import EAs that help transform the charts into other chart types. Virtually, there is nothing that the MetaTrader 4 cannot do for the retail trader.

Then, one might ask – why is there a need for the MetaTrader 5 platform?

Pros:

- Easy to install and use

- Offered by most brokerage houses

- Traders can change the broker and import the previous analysis with the new one that offers MT4

- Great for auto trading

- Consumes few PC resources

- Allows hedging

Cons:

- There are few technical indicators with the standard version, although indicators can be easily imported

MetaTrader 5

MetaTrader 5 was born on the need for a different platform suitable for jurisdictions where regulation had certain conditions to be met by brokers. For example, in the United States, hedging in the forex market is prohibited. Hence, to address the needs of brokers offering services in the United States, MetaTrader5 appeared on the market.

It is a great platform, mainly similar to the MetaTrader4, but with additional features like the one mentioned above. One would say that it is an upgrade of the MT4, but the truth is that even so many years after the MT5 appeared, many forex traders still prefer the MT4.

Pros:

- All of the pros listed for MT4 except it doesn’t allow hedging

Cons:

- It doesn’t allow hedging

Trading View

TradingView has grown spectacularly in the past years. From just another third-party tool, it quickly became the reference to an industry already crowded with numerous trading platforms.

Nowadays, TradingView also offers brokerage services, so traders can connect their accounts at various brokers with their platform and actively trade from TradingView.

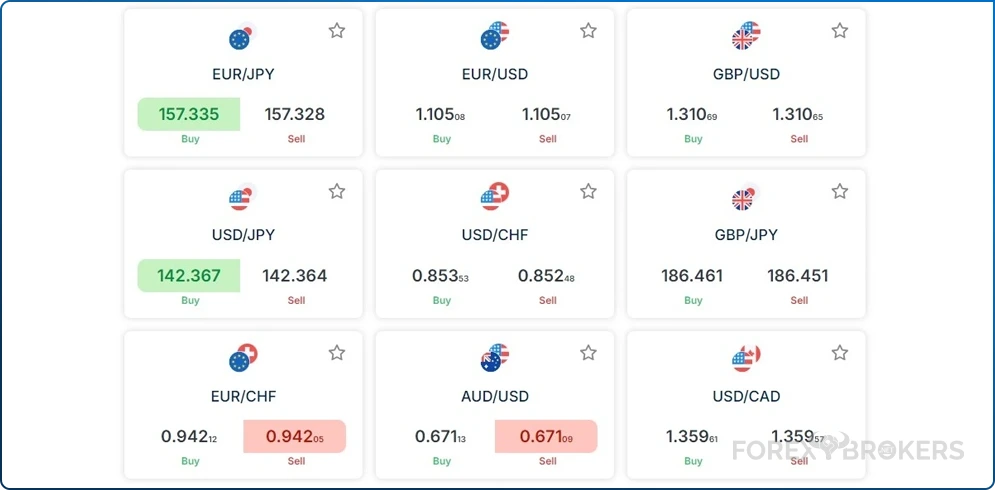

Returning to the TradingView platform, we see it is more than just a trading platform. Sure enough, all the currency pairs are there, from the classic majors, such as EUR/USD or USD/JPY, to exotic currency pairs. The platform also features numerous markets, from fixed income to stock market indices and from cryptocurrencies to commodities.

Pros:

- Covers every possible market

- Constantly updated

- Easy to us

Cons:

- Charting tools aren’t user-friendly

- Some advanced features are available only with a subscription

cTrader

cTrader belongs to a London-based company and is primarily used by ECN (Electronic Communications Network) brokers. It was first launched with FxPro before being offered by other brokers.

It quickly became adopted by the retail community, and now it is a choice for many. Brokers want to attract as many customers as possible, stand out, and offer multiple trading platforms to their clients.

cTrder is one of those options, and one should not be surprised to see it provided alongside MT4 and MT5 platforms.

Pros:

- Level II pricing

- 70+ preinstalled indicators

- User-friendly

Cons:

- Limited broker availability

- Proxy network connection

ZuluTrade

ZuluTrade describes itself as a social intelligence platform that helps traders invest intelligently. Social trading is a form of copy trading, where traders follow other successful traders and copy their trades instantly when they occur.

The copying is made via ZuluTrade’s trading platform. The company is active in over 150 countries and is regulated globally.

Pros:

- Copy trading service

- Terminal connection with other platforms such as MT4, MT5

- A large variety of assets to trade

Cons:

- One can place trades only through partnered brokers

NinjaTrader

For this, you need to install the desktop version, and from the control center window, under the connections tab, go to configure. There, you can find the forex currency pairs.

Pros:

- C

- Advanced trade management

- Order flow analysis

- Advanced charting

- Depth of market to analyze prices and place orders

Cons:

- Monthly fees

- Lifetime plan for lower trading fees

Third-Party Tools

Various companies provide third-party tools that supplement financial market participants with tools to complement their analysis. Mainly, they enable computational power and cutting-edge analysis.

AutoChartist

Autochartist came to market ten years ago. It provides brokers with advanced analysis tools and technology that scans global markets for opportunities and possible trading setups. Over five million traders around the world enjoy the software.

It aims to be one of the most complete third-party tools, diving into technical, sentiment, macroeconomic, fundamental, statistical, and volatility analysis.

Trading Central

Trading Central offers investment insights. It has been active on the market for over a century and serves over 100 million users. It provides insights into fundamental and technical analysis, news and sentiment, and options insights.

What Should You Look for When Choosing a Forex Trading Platform?

Choosing the right one from the best online trading platforms is not an easy task.

First, not all platforms are the same. Second, not all traders need the same features. Third, not all tools are required.

Therefore, the trader must know their expectations before choosing a trading platform. For example, a technical trader uses a trading platform much more than a fundamental one.

The fundamental trader only needs the platform to send the trades’ instructions and set the risk management parameters. However, technical traders mostly use the platform to analyze past price behavior.

This daunting task consumes time and requires a lot of resources before reaching a conclusion on whether to buy or sell. As such, for technical traders, the trading platform and what it features is more important than for fundamental traders.

A good trading platform should have numerous technical indicators, such as trend and oscillators. Other tools are also recommended, such as Fibonacci ratios or pattern recognition. It should also be capable of handling automated trading.

Additionally, it’s essential to choose platforms that are regulated by some of the most reliable forex authorities, such as the Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and the Commodity Futures Trading Commission (CFTC) in the US.

These regulators ensure that platforms operate securely and transparently.

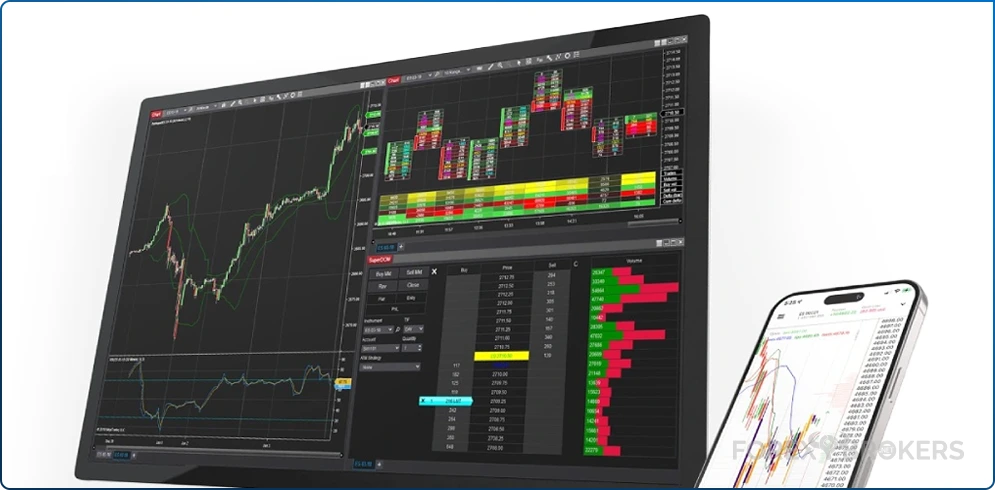

The app should be the trading platform’s extension. It should be easy to connect to and use as traders would monitor their positions on the go.

Should You Avoid When Choosing a Forex Trading Platform?

It is best to avoid web-based forex trading platforms. They are usually slow and have limited resources.

Another thing to consider is the mobile trading app. It acts as an extension of the desktop-based platform, so you want to avoid a app that does not function properly.

Expert Tip – Trading Platforms

Most brokers dedicated to retail traders have opted for trading platforms already available, like the MetaTrader4 and MetaTrader5. The advantages of using them are their robustness, viability, and ease of use.

However, some brokerage houses have decided to build their own platforms. They have the resources to develop and improve them over the years.

The final decision to pick the right one from top trading platforms belongs to the trader. For beginners into forex traders, MetaTrader 4 is the perfect choice. It even allows hedging.

More experienced traders might want to try other, more sophisticated platforms. It doesn’t mean that they will improve your profitability. In the end, it is the trader’s analysis and risk appetite that are responsible for success in financial markets.

FAQ

MetaTrader is the most popular trading platform for retail traders. The vast majority of brokers offer it, and its most significant advantage is that it can be customized with the broker’s logo.

However, the features are the same, making it easy for the trader to switch from one broker to another. It comes in two versions – MetaTrader 4 and MetaTrader 5- both have advantages and disadvantages for different trading styles.

A copy trading platform allows you to replicate the positions of a lead trader in your account. You can set the risk parameters based on your risk profile, and the platform automatically copies the trades into your account without you having to do anything.

Also, whenever the lead trader closes a position in the leading account, the copy trading platform closes the corresponding one in your account. Copy trading became popular because inexperienced traders can follow traders with a proven track record and thus profit from market movements.

A social trading platform is similar to a copy trading platform. It allows traders to connect and share information about trades and even use copy and mirroring trading.

A trading platform should be easy for anyone to use, but the reality is that some are more suitable for beginners than others. MetaTrader 4 is a great platform to learn the ins and outs of technical analysis.

It also has an excellent feature for automated trading, allowing you to build and set up your own Expert Advisor. On top of the above, installing and consuming few resources from your PC is easy. Finally, the app is user-friendly and rarely fails.

It depends on the broker you are using. With the cryptocurrency market increasing in popularity, many forex brokers also rushed to offer their clients this market. It is not unusual for forex brokers to do so.

For example, one can trade gold, oil, or other commodities on almost all forex trading platforms. However, it should be noted that cryptocurrency trading is not available on all forex platforms. Also, some that do offer the option have only a limited number of cryptocurrency pairs listed.

You can sometimes do so, but that is not how 21st-century trading goes for retail traders. For example, some brokerage houses have dedicated brokers that execute the investor’s orders received by phone.

In other words, the investor says what he wants to do in the market, and the broker executes it. This way, the investor does not need a trading platform. However, such an option is costly and usually applies only to high-net-worth individuals. Retail traders use a trading platform to send their orders to the market, and the brokerage house provides it.